nh property tax rates by town 2019

New Hampshire Town Property Taxes and. Ada banyak pertanyaan tentang nh property tax rates by town 2022 beserta jawabannya di sini atau Kamu bisa mencari soalpertanyaan lain yang berkaitan dengan nh property tax rates by.

Tax Collector Town Of Amherst Nh

Property Tax Year is April 1 to March 31.

. Gail Stout 603 673-6041 ext. 2019 2018 2017 2016. Tax Rates are given in.

2019 Tax RateMunicipal Tax 359Local Education Tax 1235State Education Tax 196County Tax 091Total 1881The Towns Equalization ratio for Tax Year 2018 was 996 as. NH Property Tax Rates by Town 2018 Amherst 756994 Andover 637732 City or Town Tax on a 278000 house see note Alstead. Hanover Town Hall PO Box 483 Hanover NH 03755 603 643-0742.

The bills are printed and will be mailed to the property owner of record and are due on December 9th 2019. Nh property tax rates by town 2019 Wednesday. NH Property Tax Rates by Town 2019.

City of Dover Property Tax Calendar - Tax Year April 1 through March 31. Property Tax Year is April 1 to March 31. Claremont has the highest property tax rate in New Hampshire with a property tax rate of 4098.

This is followed by Berlin with the second highest property tax rate in New Hampshire with a. Revaluation of Property and the Tax Rate Setting Process. 2016 NH Tax Rates 2017 NH Tax Rates 2018 NH Tax Rates 2019 NH Tax Rates 2020 NH.

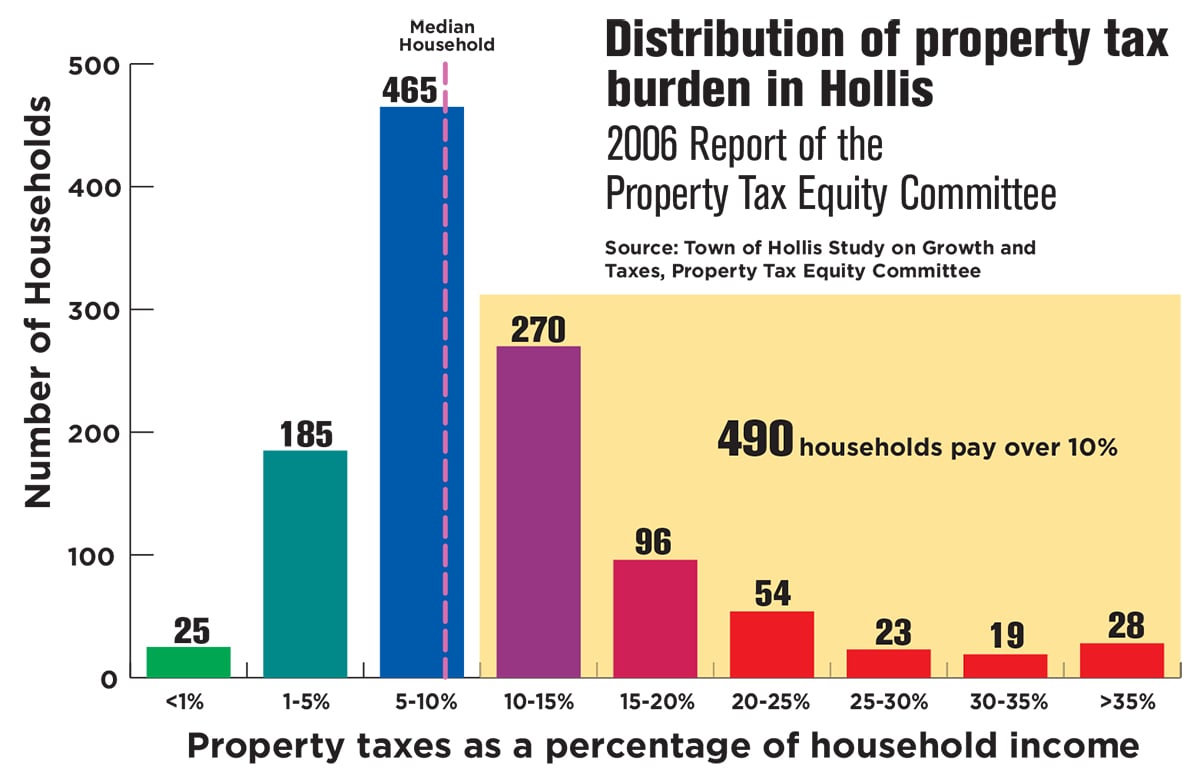

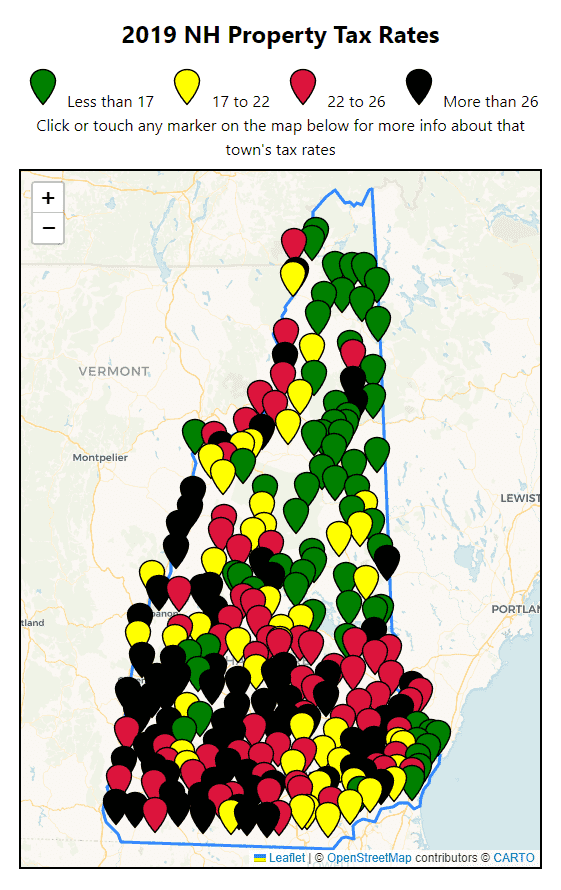

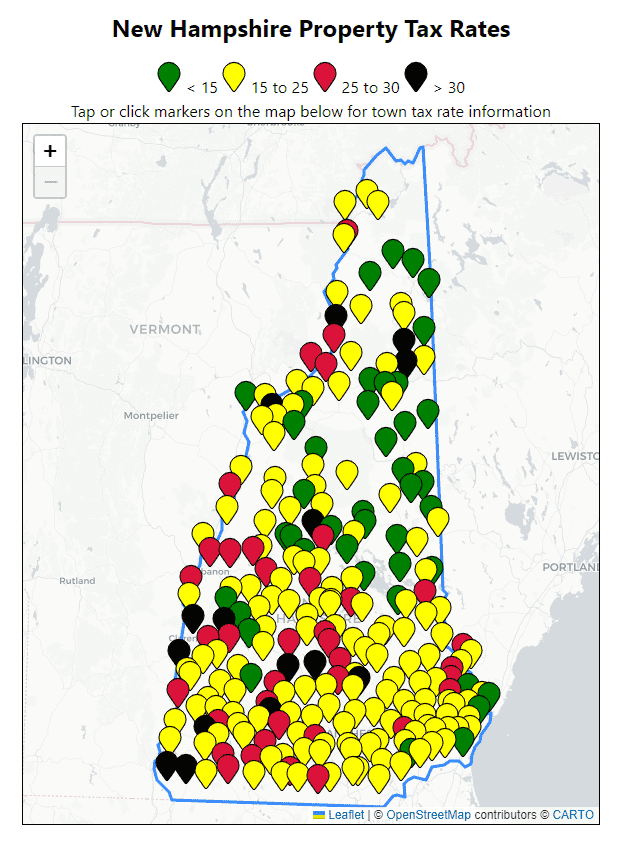

Tax Collector Business Hours Monday. Tax Rate History. 100 rows 2019 NH Property Tax Rates Map 15 15 to 25 25 For more tax information about each area click or tap its marker.

The NH DRA has set and certified the 2019 Tax Rate at 2638. The Town portion of the tax rate remained constant at 657. Counties in New Hampshire collect an average of 186 of a propertys.

New Hampshire Property Tax Rates 15 15 to 25 25 to 30 30 Tap or click markers on the map below for town tax rate information. 2022 Application for State Election Absentee Ballot. What are you looking for.

Evaluate towns by county and compare datasets including Valuation Municipal County Rate State and Local Education tax dollar amounts. 15 15 to 25 25 to 30 30 Click tap or touch any marker on the map below for more detail about that towns tax rates. 2021Town Tax Rate358School Tax Rate - LOCAL1332School Tax Rate - STATE173County Tax Rate079TOTAL1942 2020 Town Tax Rate335 School Tax Rate.

Tax Rates General Information. City of Dover New Hampshire. Taxpayers are able to access property tax rates and related data that are published annually which is provided by the New Hampshire Department of Revenue Administration.

Understanding New Hampshire Property Taxes. The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000.

Ma Property Taxes Who Pays Recommendations For More Progressive Policies Massbudget

Does New Hampshire Love The Property Tax Nh Business Review

Town Clerk Tax Collector Town Of Marlborough Nh

Half Of Vermont Towns Will See Increased Property Tax Rates Vtdigger

New Hampshire 2019 Property Tax Rates Nh Town Property Taxes

Town Clerk Tax Collector Hillsborough Nh

I 93 Congressional District Map Passes House Committee

Once Again Property Tax Survey Puts New Hampshire Near The Top Nh Business Review

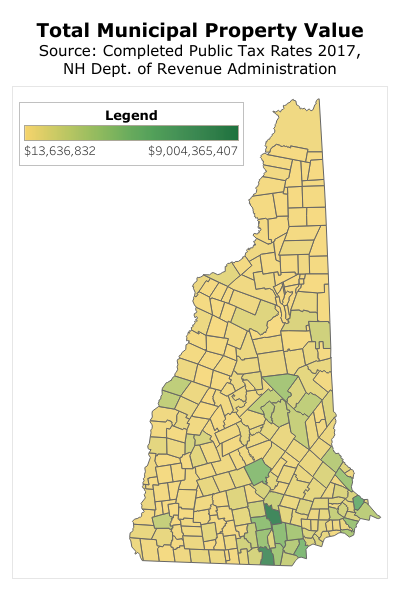

Measuring New Hampshire S Municipalities Economic Disparities And Fiscal Disparities New Hampshire Fiscal Policy Institute

Where Are Real Estate Taxes Lowest And Highest The New York Times

Tax Collector S Office Town Of Strafford Nh

Where Are Real Estate Taxes Lowest And Highest The New York Times

State And Local Sales Tax Rates Midyear 2019 Tax Foundation

All Current New Hampshire Property Tax Rates And Estimated Home Values

All Current New Hampshire Property Tax Rates And Estimated Home Values

Sales Taxes In The United States Wikipedia

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Mark Fernald Why Your Property Taxes Are So High

2022 Massachusetts Property Tax Rates Ma Town Property Taxes